Loans in 3 minutes

An enterprise-level solution reduces the waiting time of applying for a business loan like an overdraft within a branch from 32 days to 3 minutes. This project entailed delivering a platform-agnostic system and process improvement to ensure customers could open new lending accounts faster, ensuring quick disbursement of approved funds. All business clients had a required waiting time of 32days when applying for credit and getting access to urgently needed funds should not be a tricky part of our business lives, so trying to build a solution that was user friendly and informative would require a lot of pre-work, and rapid iteration.

Role: User experience designer for the Business Lending team.

Client: Standard Bank, business banking

Project date: June – September 2021

The Challenge

All business clients had a required waiting time of 32days when applying for credit and getting access to urgently needed funds should not be a tricky part of our business lives, so trying to build a solution that was user friendly and informative would require a lot of pre-work, and rapid iteration.

The Solution

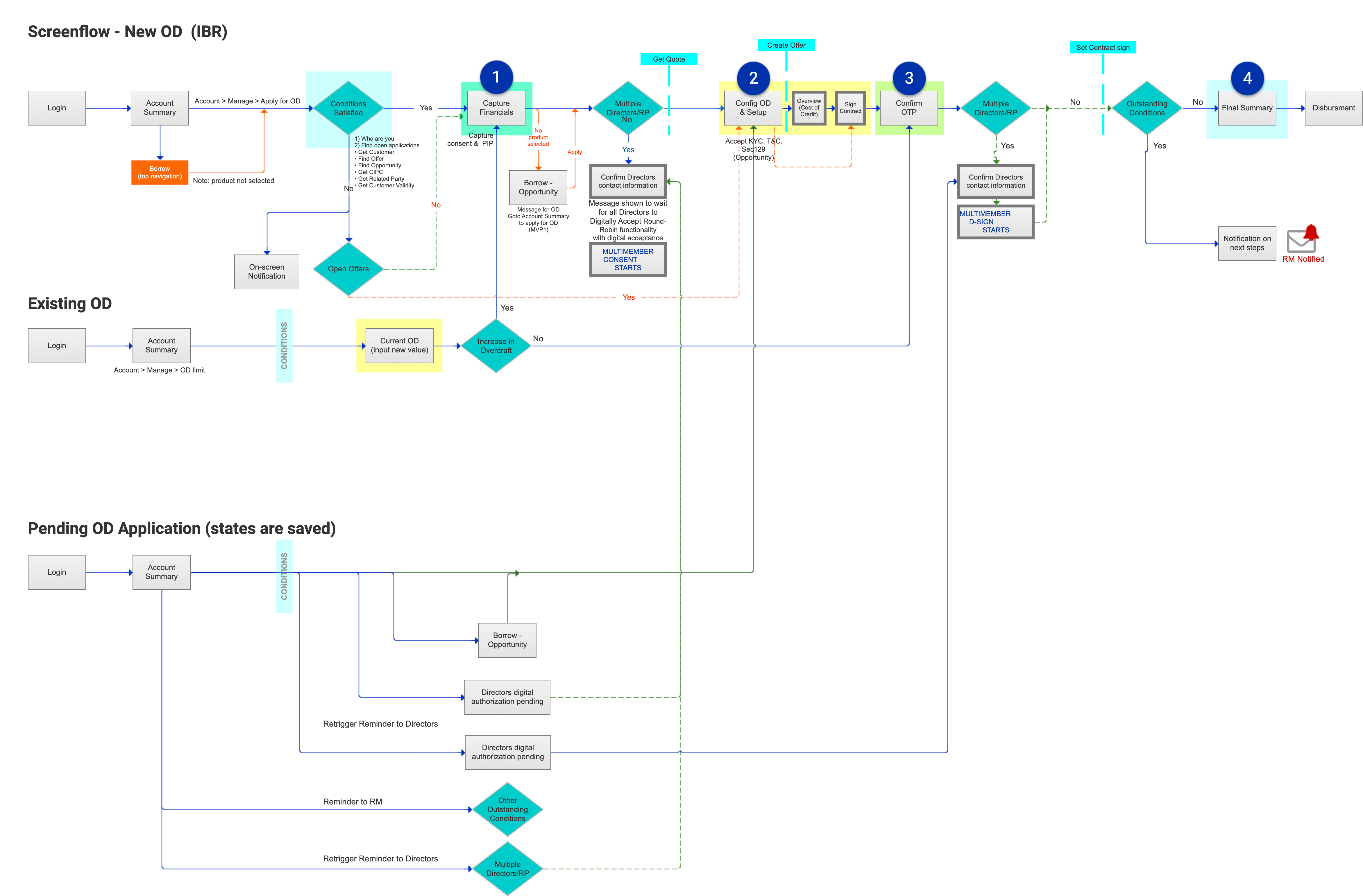

Our discovery phase included a re-imagination workshop which brought all the relevant stakeholders together from tech leads to customer-facing staff as well as product tear-downs of competitor products in the market The findings from this were used to further inform and craft our initial JTBD along with our initial conceptual journey design and ideation opportunities.

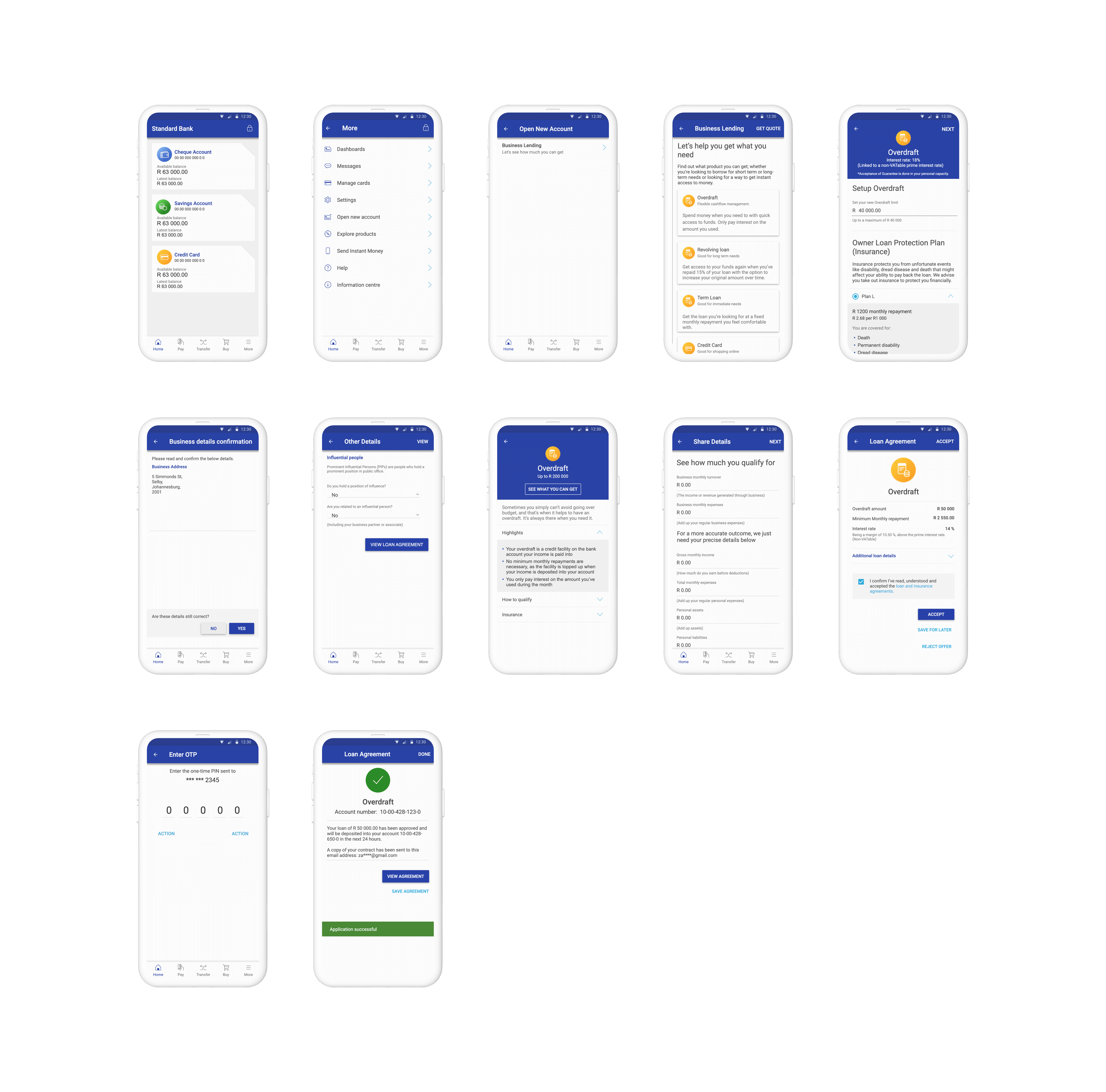

Following the page flows, we identified any reuse of components for pages and started with low fidelity wireframes and the isolation of edge cases and negative flows and played back to the business lending team. Next, a high fidelity prototype which included the sensitisation of any new patterns for approval and our journey work updated for approval was played back to the team before moving on to user testing of our POC working together with the technical and business team to make sure we are all aligned with the team mission.

The prototype was user tested with 10 respondents and iterations were refined and implemented on the prototype as the findings were being synthesised, the findings were played back to the business lending team. I strongly believe in validating complex user interactions by testing them and refining them based on focused user testing and research. Designs were then handed over to dev, using Zeplin.

Standard Bank has seen a significant uptake of its new three-minute loan facility since it was launched on September 12 2019, with more than R460m issued to small- and medium-sized enterprises (SMEs) in the period leading up to February 16 2020. Source : Timeslive.

180

460

”I remember Craig’s out-of-the box solutions and unorthodox thinking brought in a fresh perspective to our

Girish DhulekarUX Lead, Personal & Business lending

Business Overdraft solution, helping in the creation of a seamless process for the users.

”Craig’s eye for details coupled with his big picture perspective on projects enabled him to deliver solutions that take into account the entire customer journey and add genuine value to the project.

Matthew WateUX Research Lead