Digisign

We were tasked with creating an enterprise-level solution that meets the standards of a Digital Signature as stipulated by ECTA for all products to have documentation digitally signed and enable clients to do their KYC online to eliminate the need for clients to be present to sign documents on account origination/maintenance, Inconvenient branch visits for existing KYC compliant customers to sign documents & Courier/ RM travel costs to acquire customer’s signature.

Role: User experience designer for the Business Lending team.

Client: Standard Bank, business banking

Project date: July – November 2019

The Challenge

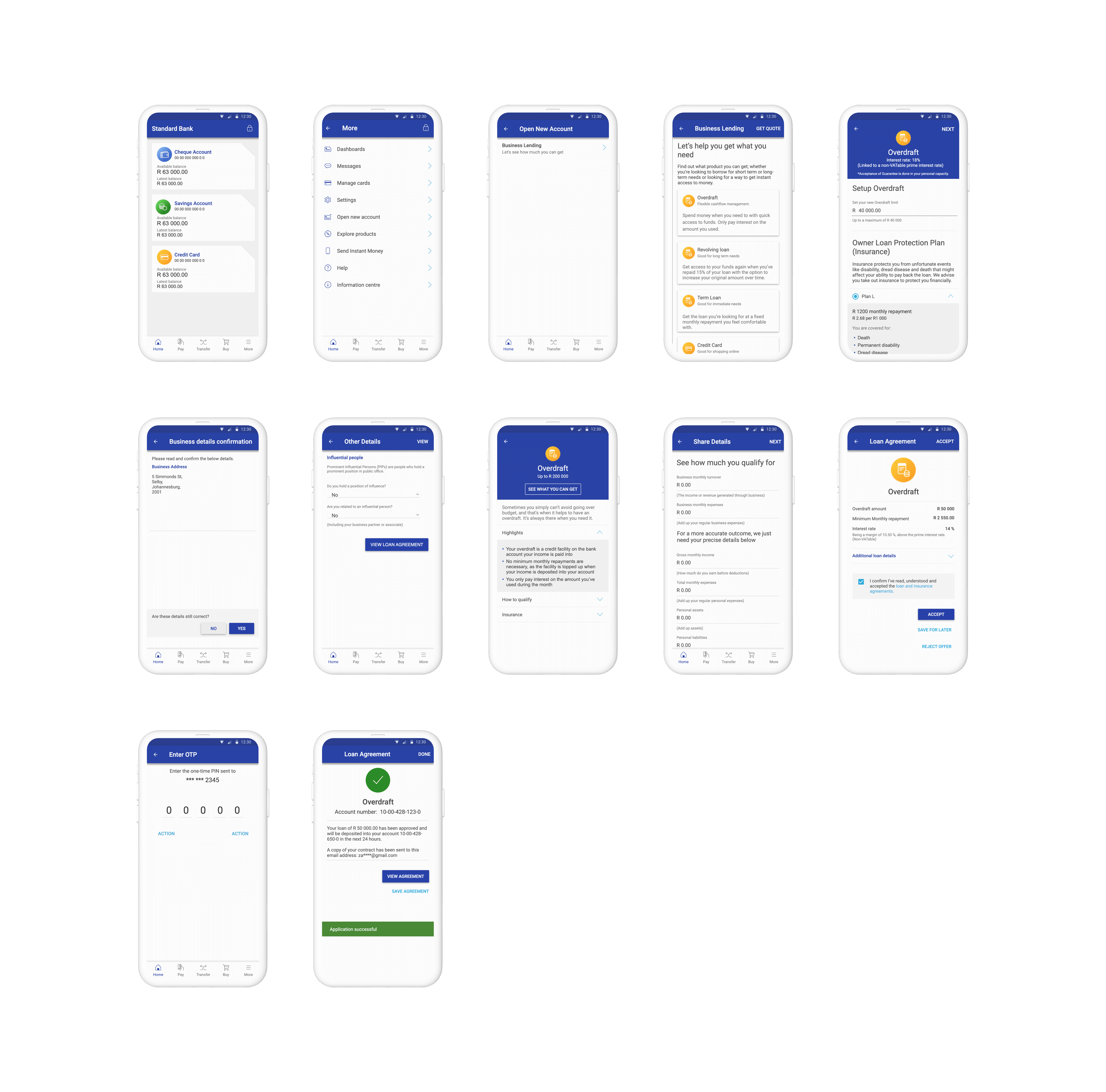

Customer required to be present to sign documents on account origination/maintenance, Inconvenient branch visits for existing KYC compliant customers to sign documents. Courier/ Relationship manager travel costs to acquire customer’s signature. The solution meets the standards of a Digital Signature as stipulated by the electronic communications Act 36 of 2005. An enterprise-level solution for all products to have documentation digitally signed. They enable customers to complete documentation requirements wherever they are, reducing the need to visit branches and saving customers’ time.

The Solution

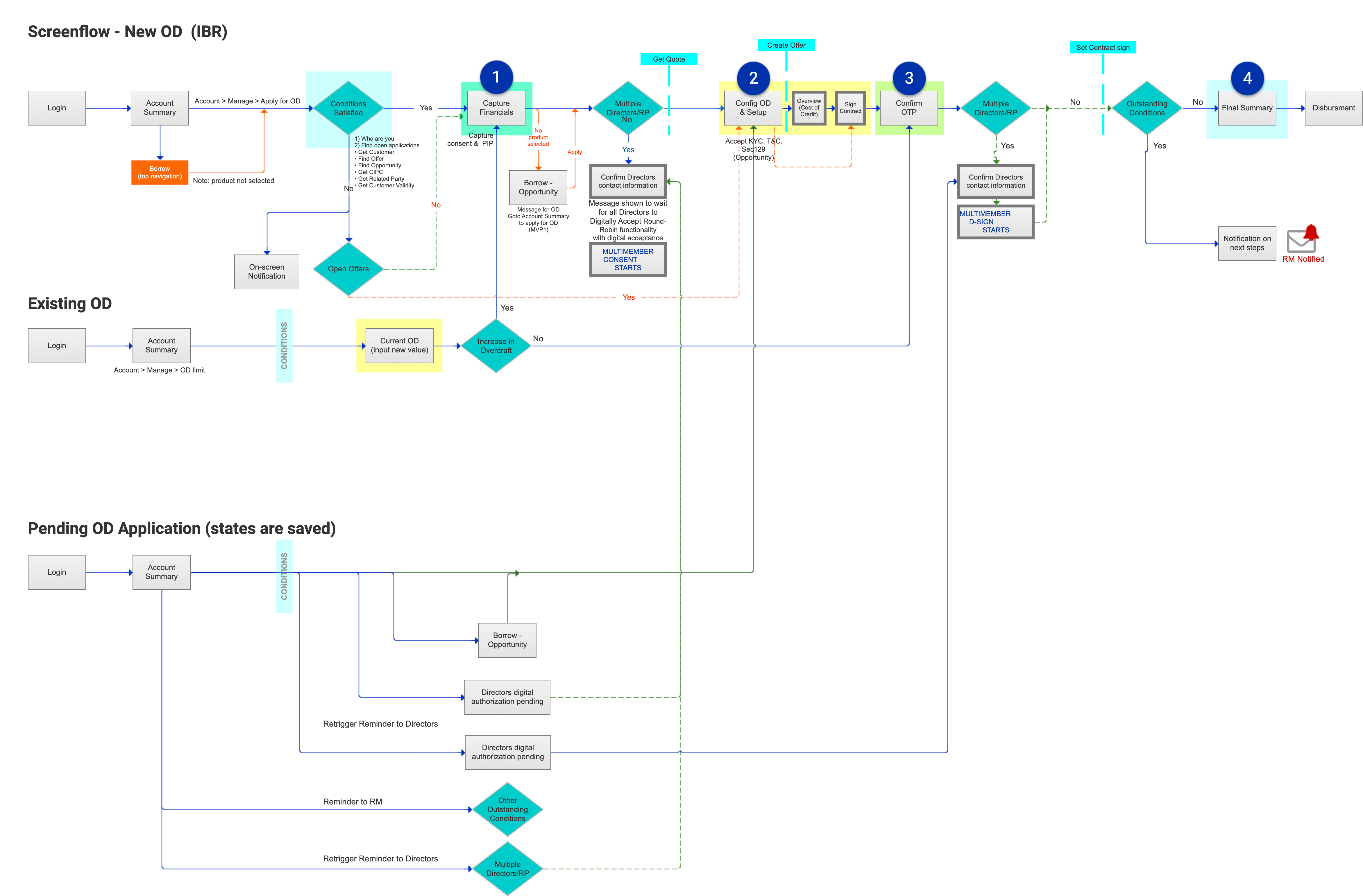

Our discovery phase included a product enhancement workshop which brought the relevant stakeholders together from tech leads to customer-facing staff & SME’s to help us better understand the requirements per product when signing for a loan. In addition, the findings were used to inform further and craft our initial JTBD and our initial conceptual journey design and ideation opportunities. Following the page flows, we started with low fidelity wireframes, and isolation of edge cases and negative flows were then played back to the business lending team.

Next, a high fidelity prototype which included the sensitisation of the enhanced pattern for approval and our journey work updated for approval was played back to the team before moving on to user testing of our POC working together with the technical and business team to make sure we are all aligned with the team mission. The prototype was user tested with eight respondents, and iterations were refined and implemented as the findings were being synthesised. Finally, the findings were played back to the business lending team, and we then moved into the development stage, where design and dev worked closely together to ensure parity of the design.

Having a more significant, more complex business with multiple business partners calls for a simple, easy-to-use and easy-to-understand method of doing your KYC and signing documents that all parties involved understand and find easy to use in an easily digestible snapshot of the current status of customer’s KYC or signature status. This feature enables all customers to do that. I owned the mobile and tablet and desktop design for this experience.

Reduce unnecessary complexity and admin for branch staff and Relationship Managers so they can FOCUS TIME AND EFFORT on the right things for customers, themselves and Standard Bank

Accelerate the journey to PAPERLESS BANKING by reducing paper, printing and storage activities in branches

”This is an enterprise solution that cuts across different systems and products, enabling customers to sign agreements in the comfort of their homes

Nonkosi KuluSME, Senior Solution Owner, Business and Commercial lending

”I have seen Craig grow from being completely new to UX, to being one of the most proficient UX designers…

Girish DhulekarUX Lead, Personal & Business lending

He’s also very fast in learning new tools, innovating user feedback methods and implementation of the same in his design. He’s truly an asset to any team and I wish him luck for his future.